Documents Needed for FAFSA or WASFA

The Free Application for Federal Student Aid (FAFSA) is a form completed by current and prospective college students in the United States to determine your eligibility for student financial aid. The Washington Application for State Financial Aid (WASFA) is for people who don’t file a federal FAFSA application.

You will need a number of official documents to complete the respective applications. It's also a good idea to have a parent or guardian with you to help you answer questions when you are completing the application.

Note: This information is also available as a PDF.

Documents for FAFSA

If you and your contributor have any of the following:

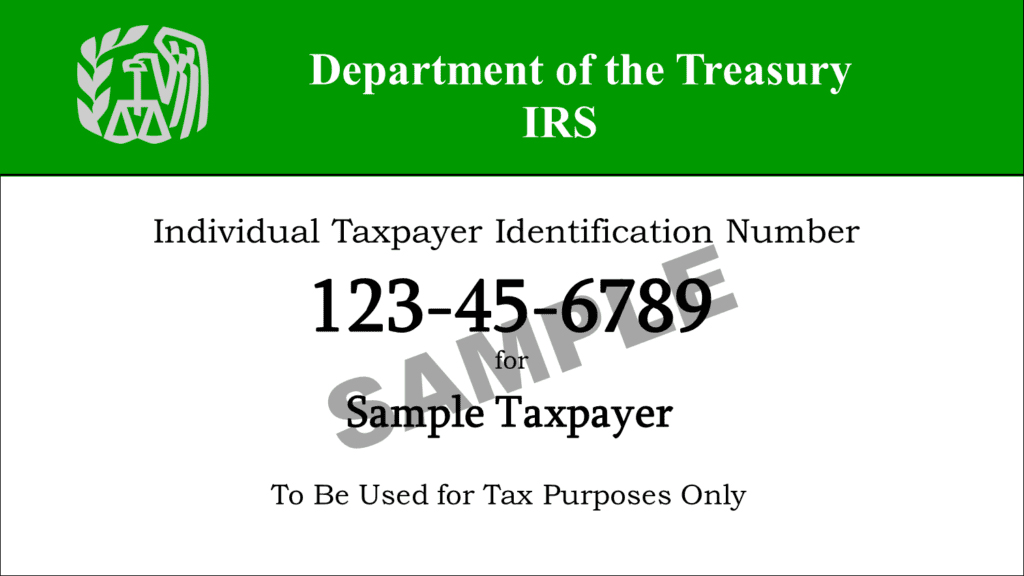

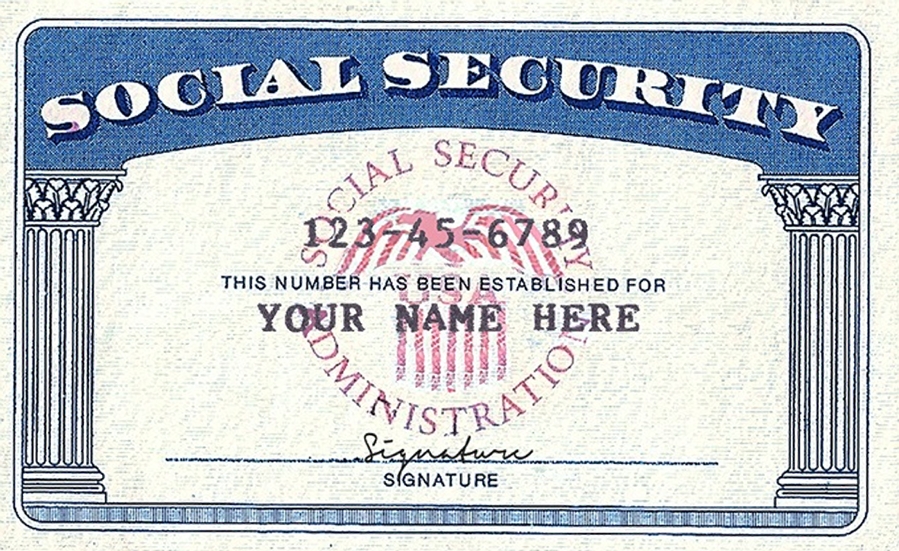

- Social Security Number

Found on Social Security card

- USCIS Number (if you are not a U.S. citizen)

Found on Green Card (Permanent Residence Card)

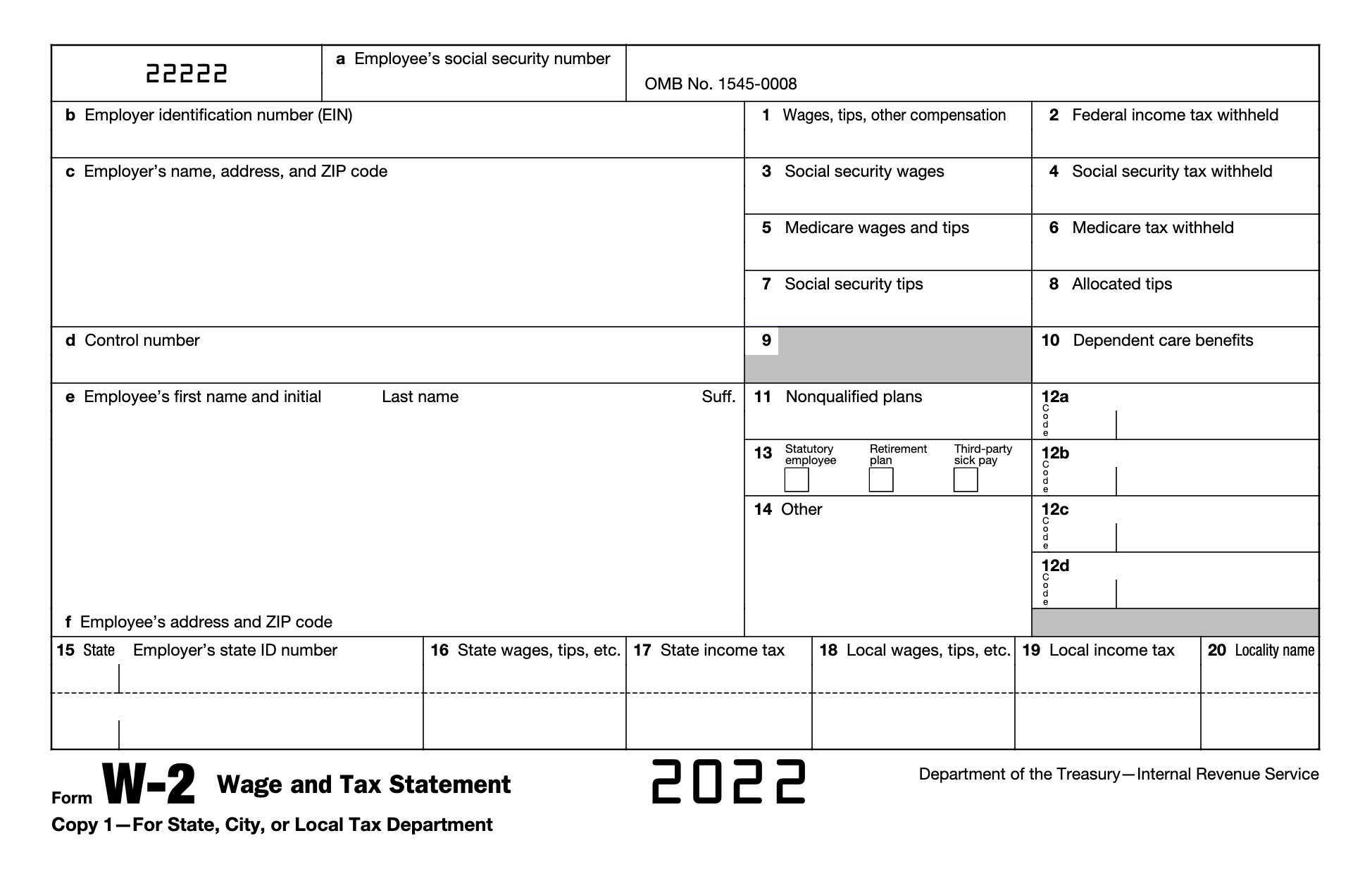

- Federal Income Tax Returns, W-2s, and other records of money earned

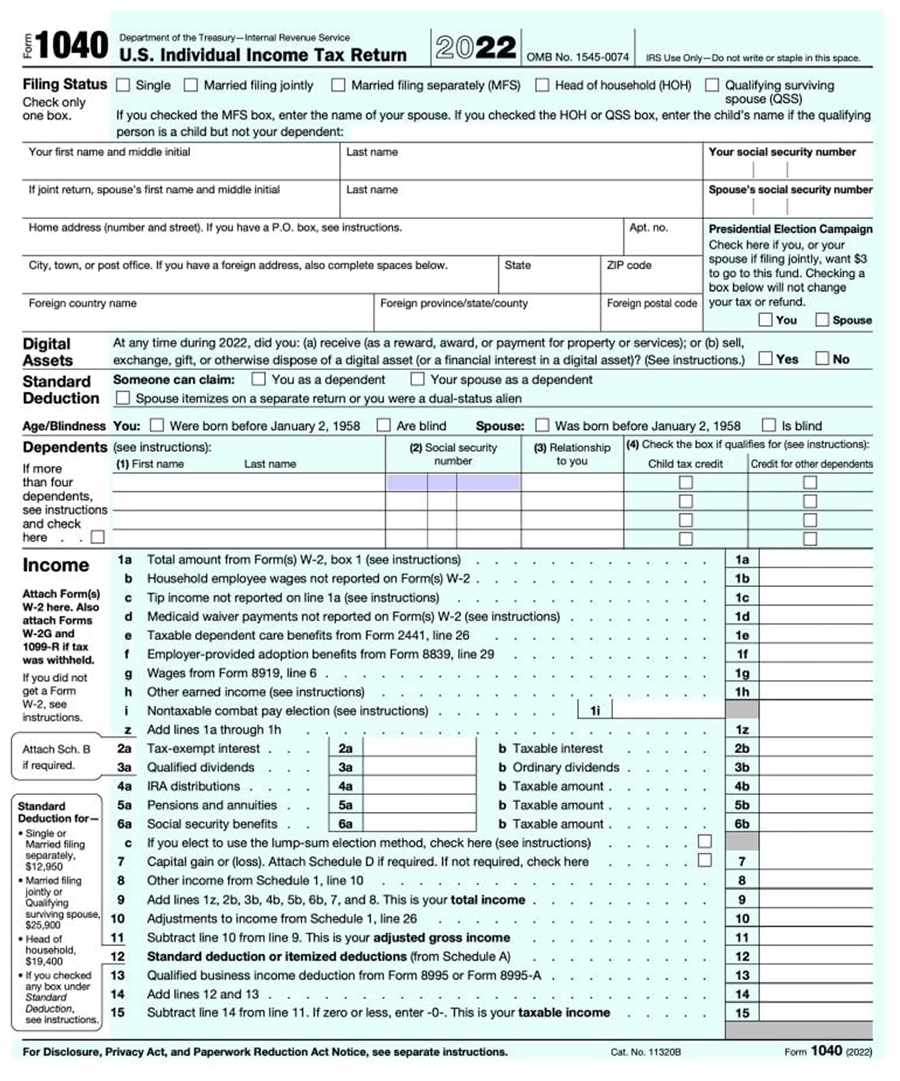

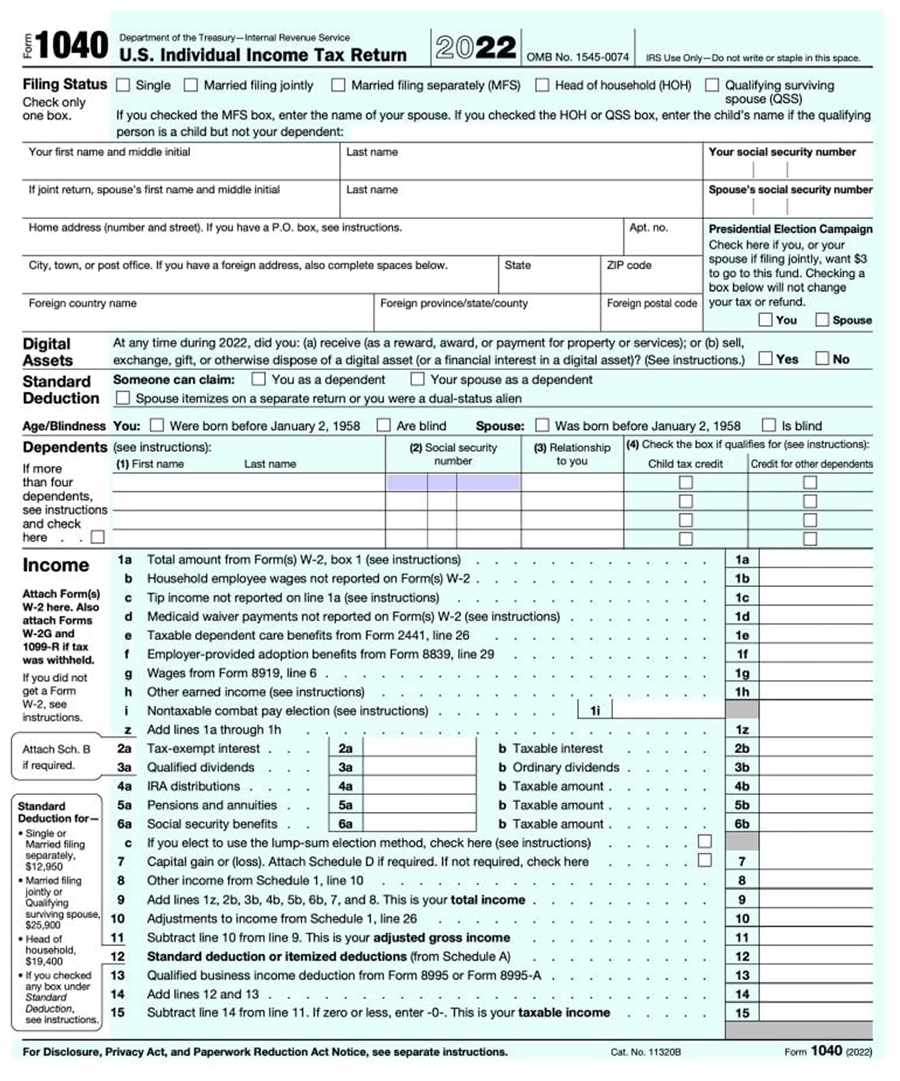

- Copy of 2022 Tax Return

(Most often a 1040, 1040A, or 1040EZ)

Note: You may be able to transfer your federal tax return information into your FAFSA using the IRS Data Retrieval Tool.

- 2022 W-2 (will look similar to image below)

- Copy of 2022 Tax Return

- Driver’s License Number (if applicable)

- Bank Statements

- Records of Untaxed Income (if applicable)

- Additional Financial Information (if applicable)

- Child support statements

- TANF or welfare information

- Real estate or stocks and bonds investments

- Family business or farm information

- An FSA ID to sign electronically

If you have not done so already, create an FSA ID for yourself and a parent/guardian at https://fsaid.ed.gov/npas/index.htm

Documents for WASFA

If you and your contributor have any of the following:

- Driver’s License Number (if applicable)

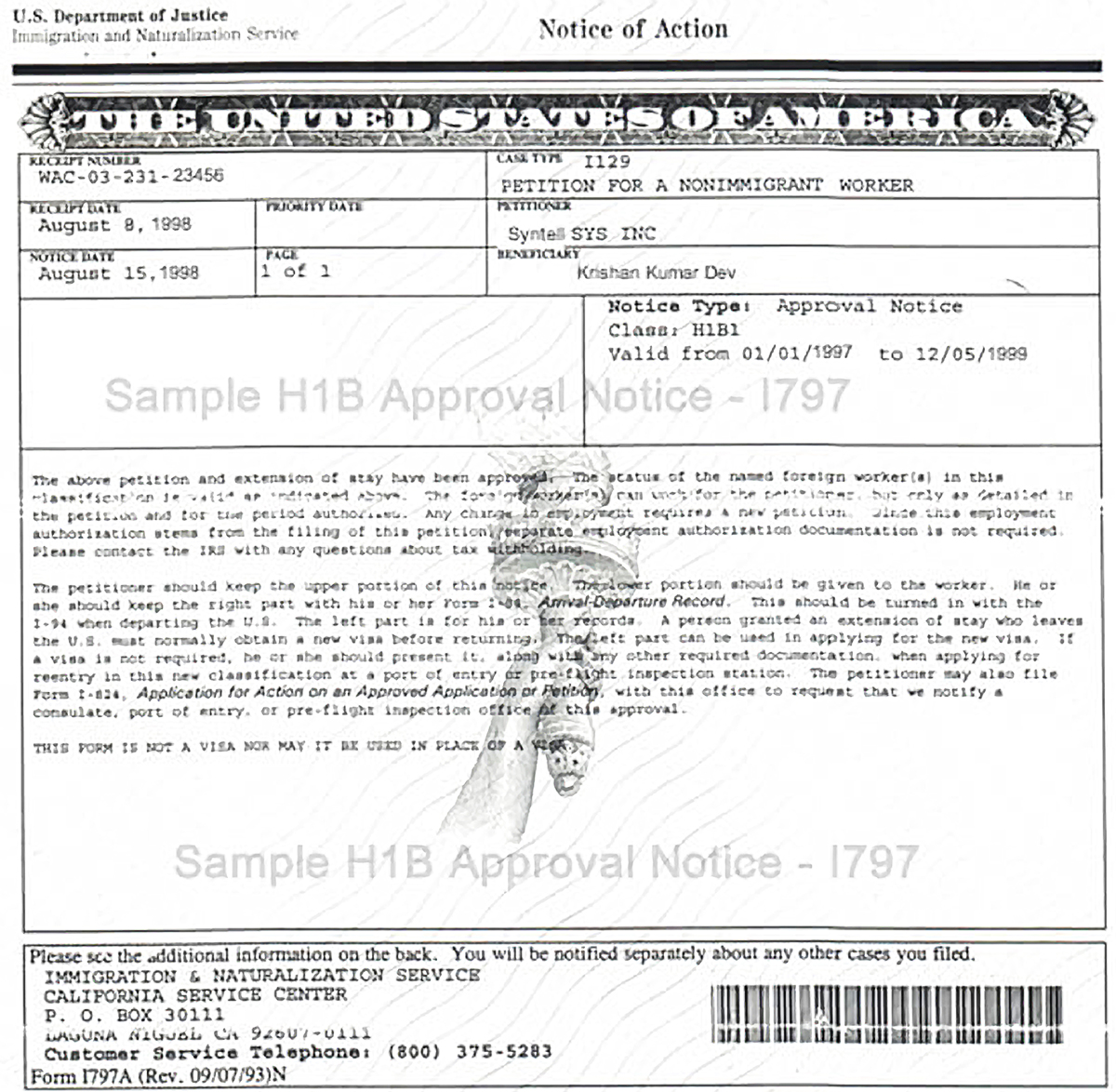

- I-797 Form (if applicable)

- Current or Expired DACA Status (if applicable)

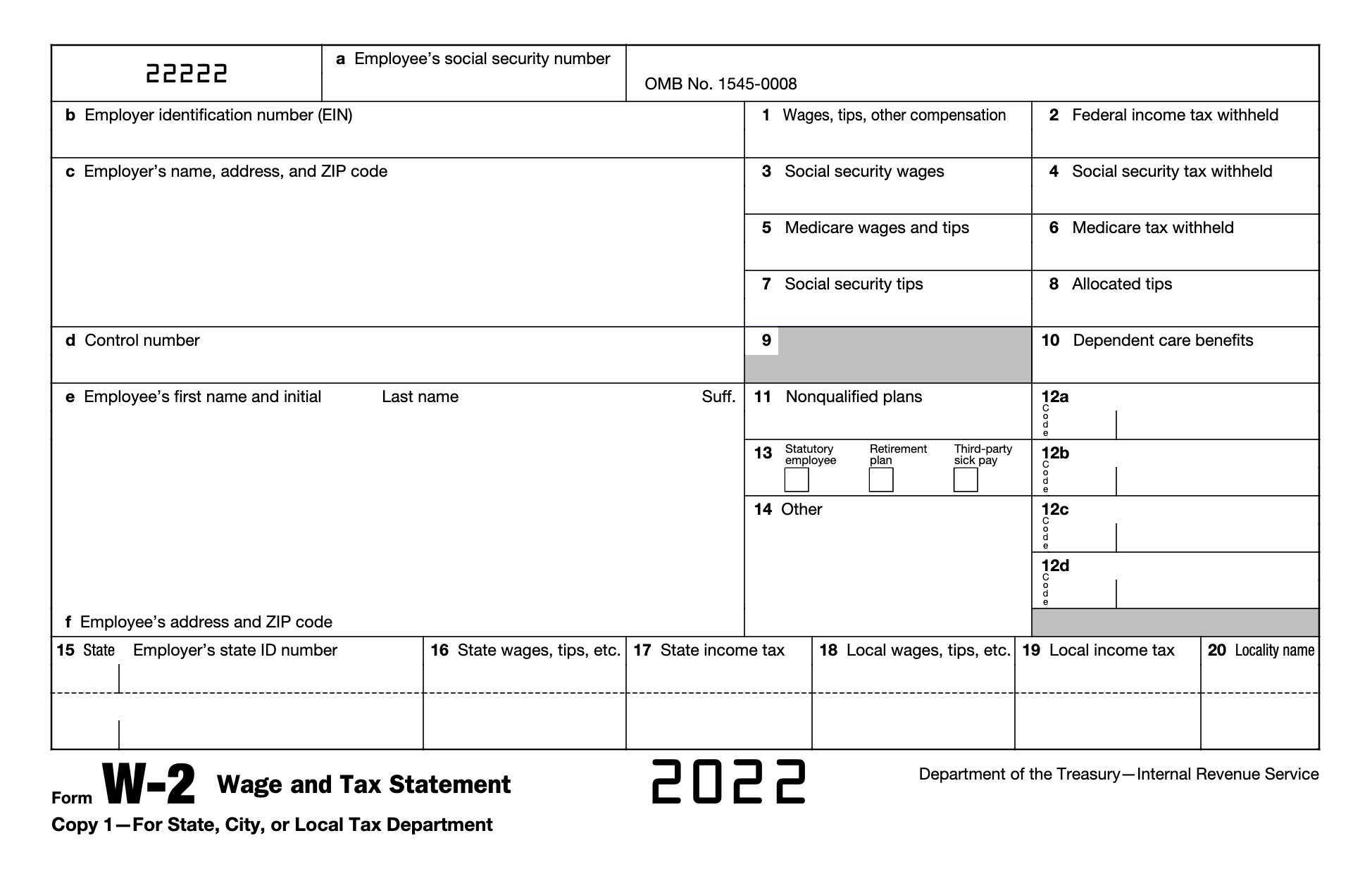

- Federal Income Tax Returns, W-2s, and other records of money earned

- Copy of 2022 Tax Return

(Most often a 1040, 1040A, or 1040EZ)

Note: You may be able to transfer your federal tax return information into your FAFSA using the IRS Data Retrieval Tool.

- 2022 W-2 (will look similar to image below)

- Copy of 2022 Tax Return

- Additional Financial Information (if applicable)

- Child support statements

- TANF or welfare information

- Real estate or stocks and bonds investments

- Family business or farm information

- Note: If you have an ITIN or Social Security Number, include this information on your WASFA (Not Required)